In early 2025, former President Donald Trump announced a sweeping set of aggressive tariffs aimed primarily at China and the European Union, reigniting fears of a global trade war. These tariffs, including a substantial 54% duty on Chinese imports and a targeted 25% levy on European automotive products—particularly German cars—pose immediate risks to global economic stability.

Investors are concerned: previous trade conflicts have proven costly, causing inflation spikes, market volatility, and disruptions to global supply chains. This latest policy move, viewed as Trump’s toughest yet, threatens similar or even greater economic upheaval.

In this article, we break down the facts behind Trump’s 2025 tariffs, analyze their potential impact on global markets, and offer insights to help investors navigate the uncertainty ahead.

Trump’s 2025 Tariffs Explained: Key Countries & Products Affected

Former President Donald Trump’s latest round of aggressive tariffs, announced in early 2025, has investors and global markets on high alert. These measures specifically target major economies, notably China and the European Union, sparking renewed fears of economic instability and trade tensions worldwide. Here’s a concise breakdown of the key countries, products impacted, exemptions, and critical dates investors should watch closely.

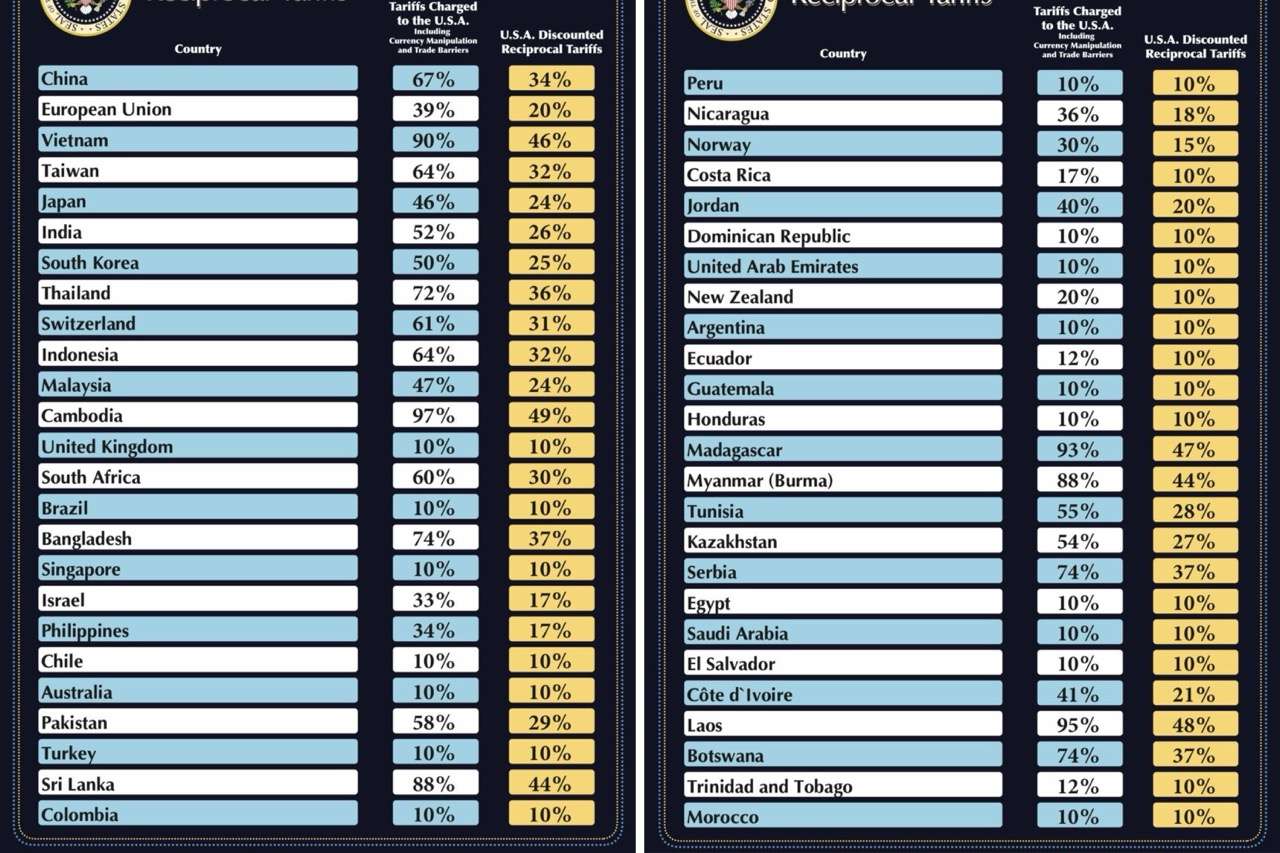

Comprehensive List of Countries Targeted by Trump’s 2025 Tariffs

China: Severe 54% Import Tariff

- Reason: Directly linked to Trump’s declared battle against fentanyl and drug trafficking.

- Impact: Significantly raises costs for imports from China across multiple sectors, drastically affecting supply chains and consumer prices in the U.S.

European Union: 25% Automotive Import Tariff

- Key Target: German automotive industry (luxury and consumer vehicles).

- Reason: Intended to strengthen domestic U.S. automotive manufacturing by sharply raising costs on imported European cars.

- Impact: Potential severe reduction in European car exports to the U.S., especially premium brands such as Mercedes-Benz, BMW, Audi, and Volkswagen.

Products Temporarily Exempt from Trump’s 2025 Tariffs

Despite the aggressive stance, the administration has temporarily exempted a limited range of essential products from these new tariffs:

- Pharmaceuticals: Critical medicines remain exempt, protecting the healthcare sector from immediate disruption.

- Semiconductors: Essential for U.S. technology and defense sectors; currently exempt to maintain critical supply chains.

- Rare Minerals: Vital raw materials with limited availability in the U.S., essential for manufacturing, technology, and defense sectors.

However, it remains unclear how long these exemptions will last, as Trump’s administration indicated future reviews and possible adjustments.

Implementation Timeline & Critical Dates Investors Must Track

- April 9, 2025: Official tariff implementation date, when the announced duties come into effect.

- Mid-April to May 2025: Potential announcements of retaliatory measures from China, the EU, and other impacted nations, further heightening economic uncertainty.

- Ongoing (Q2-Q3 2025): Critical period to monitor economic data (inflation rates, consumer spending, manufacturing outputs) to gauge the tariffs’ broader economic impact.

Investors should remain vigilant and adjust strategies according to evolving trade policy news and global economic indicators.

Immediate Sector-by-Sector Impact Analysis of Trump’s 2025 Tariffs

Trump’s 2025 tariffs are already reshaping key sectors of the economy, creating immediate consequences for businesses, investors, and consumers alike. Here’s a fact-based, concise breakdown of the critical impacts across major industries.

🚗 Automotive Industry: Sharp Price Increases & Sales Declines

- Price Hikes for German Cars:

Tariffs of 25% on EU automotive imports directly target premium German brands such as Mercedes-Benz, BMW, Audi, and Volkswagen. American consumers can expect substantial price increases, possibly ranging from $8,000 to over $20,000 per vehicle. - Sales Decline and Supply Chain Disruptions:

Increased costs may lead to significant drops in U.S. sales for European automakers, hurting both manufacturers and local dealerships. This disruption may also strain global automotive supply chains, potentially affecting component suppliers and American manufacturing partners.

📱 Tech & Electronics: Major Risks from the China-U.S. Tariff (54%)

- Impact on Consumer Electronics:

The steep 54% import tariff on Chinese goods directly threatens tech companies heavily dependent on Chinese manufacturing. American consumers could see sharp price hikes on smartphones, laptops, wearables, and other popular electronics. - Companies Most Vulnerable:

Industry giants such as Apple, Amazon, Google, Nvidia, and Meta are immediately at risk due to their significant reliance on Chinese-produced components and finished goods. Increased production costs could drastically impact profitability and market performance.

🛡️ Temporarily Exempted Industries: A Critical Reprieve

- Why Exemptions Matter:

Temporary tariff exemptions for pharmaceuticals, semiconductors, and rare minerals are vital for avoiding immediate crises in public health, technological competitiveness, and national security. - Duration Forecast:

Although these sectors currently benefit from exemptions, uncertainty remains. Analysts anticipate the Trump administration to conduct periodic reviews, potentially revisiting these exemptions within 6-12 months. Businesses should prepare contingency plans for future policy shifts.

U.S. Domestic Economic Consequences: Inflation Surge & Recession Risk in 2025

Trump’s 2025 tariff escalation is triggering immediate concerns across the U.S. economy. Leading analysts are already forecasting inflationary pressure and a potential recession within months. Here’s a concise breakdown of what to expect.

📈 Inflation Spike on the Horizon

- Estimated Increase:

Economists forecast a +1% to +1.5% jump in inflation by mid-2025, driven by higher import costs on vehicles, electronics, and consumer goods. - Price Ripple Effect:

Tariffs act like a tax on imports—raising prices for businesses and consumers alike. This ripple effect could affect everything from groceries and gadgets to home appliances and retail prices.

📉 Recession Risks in Q2–Q3 2025

- JP Morgan’s Outlook:

A recent report warns of a heightened risk of a technical recession by summer 2025, as tariffs drag down consumption and business investment. - Think Tank Projections:

U.S. economic think tanks anticipate a mild-to-moderate GDP contraction, with quarterly growth possibly dipping below zero if no mitigating fiscal measures are adopted.

👷♂️ Unemployment & GDP Forecasts

- Slowed Growth:

GDP growth forecasts for 2025 are already being revised downward, with some estimates pointing to a contraction of 0.5% to 1.2% in Q3. - Job Market Pressures:

Sectors tied to trade, logistics, retail, and manufacturing could face rising layoffs, pushing unemployment back above 5%.

🛒 The Consumer’s Wallet: Real Impact

- Reduced Purchasing Power:

As prices climb and wages stagnate, real household income is expected to fall, pressuring middle- and lower-income families the hardest. - Household Budget Squeeze:

Everyday essentials and imported goods will cost more, forcing consumers to cut spending or shift to lower-quality alternatives.

How Financial Markets Reacted to Trump’s 2025 Tariff Announcement

Trump’s latest tariff bombshell sparked an immediate response from global markets — but not the panic many expected. While investor sentiment shifted quickly, skepticism remains over whether the full scope of the tariffs will ever materialize.

📉 Initial Market Reaction: Cautious Pullback, Not Collapse

- Moderate Declines Across Indexes:

The S&P 500 and Nasdaq both dropped 1–2% in the hours following the announcement, reflecting investor unease rather than panic. - Volatility Uptick:

The VIX (volatility index) surged by 18%, signaling rising uncertainty about U.S. economic direction and global trade dynamics.

❓ Why Investors Remain Skeptical

- Political Headwinds Ahead:

Markets are factoring in potential resistance from the Republican-controlled Senate, recalling the successful pushback during the Canada tariff standoff in 2018. - Election-Year Optics:

With mid-term elections looming, analysts suggest Trump may scale back or delay key parts of the policy to avoid alienating swing voters.

📊 Stock Market Winners & Losers

- Immediate Losers:

Big Tech felt the hit first. Stocks like Apple (-3.2%), Amazon (-2.7%), Google (-2.1%), Nvidia (-3.5%), and Meta (-2.4%) all declined sharply due to their deep exposure to Chinese supply chains. - Industries Under Pressure:

- Technology & Electronics: Increased import costs and retaliatory risk from China.

- Manufacturing & Automotive: Tariff-related price hikes could reduce competitiveness and demand.

Trump’s Tariff Plan: What Comes Next? Political Scenarios & Possible Outcomes

As Trump’s 2025 tariff proposal dominates headlines, one question looms large: will these aggressive measures actually become law? The answer depends on a complex political chessboard involving Congress, public sentiment, and Trump’s own track record.

🏛️ Will the Tariffs Pass? Political Resistance is Real

- Republican Pushback Expected:

Key Senate Republicans, particularly those from manufacturing-heavy states, are already voicing concerns over economic fallout. Similar resistance blocked full-scale tariffs on Canada in 2018. - Congressional Tools in Play:

Lawmakers could deploy budgetary restrictions, legal challenges, or bipartisan amendments to dilute or delay the proposed tariffs.

🔁 Could Trump Shift Course? His Track Record Suggests Flexibility

- Negotiation as Strategy:

Trump has a history of using bold economic threats to gain leverage, only to scale back under pressure.

➤ Example: China tariffs in 2019 were partially reversed after U.S. farmers pushed back. - Public Opinion Matters:

If key demographics—like working-class voters or swing-state business owners—feel the pinch early, expect strategic adjustments before mid-term elections.

⚠️ Risk Assessment: A Politically Charged Climate

- Short-Term Uncertainty:

Policy swings and media battles could create weeks of economic uncertainty, dampening investor confidence. - Election-Year Volatility:

The tariffs may become a central issue in the 2025 mid-terms, influencing voter turnout, party unity, and campaign strategies.

Global Backlash Brewing: How the World Is Responding to Trump’s Tariff Shock

Trump’s 2025 tariff announcement has triggered immediate global concern—not just among trading partners, but across financial markets and supply chains. As tensions rise, the world braces for what could become a new era of economic fragmentation.

🇪🇺 Europe’s Response: Disjointed but Determined

- Lack of Unity Slows Retaliation:

The EU struggles to present a unified front, with diverging economic interests among member states—Germany fears automotive fallout, while others focus on agriculture and tech. - Targeting Big Tech as Leverage:

European officials are reviving regulatory threats against U.S. tech giants like Google, Amazon, and Meta. New digital taxes and data privacy fines could serve as indirect retaliation.

🇨🇳 China’s Strategy: Silent, Calculated, and Risky

- Deep Ties to U.S. Demand:

China is heavily reliant on U.S. consumer markets, especially for electronics, machinery, and textiles. This limits its immediate retaliation options, but not its long-term strategy. - Potential for Escalation:

Analysts warn of tit-for-tat tariffs, export bans on rare earths, or strategic disruptions targeting U.S. firms in China.

A full-blown U.S.-China trade war would destabilize already fragile supply chains post-COVID and inflation shocks.

🌍 Ripple Effects: Globalization at a Crossroads

- Supply Chain Reconfiguration:

Tariff instability could push companies to diversify sourcing and manufacturing, accelerating “China + 1” and nearshoring strategies. - Emerging Markets on Alert:

Export-dependent economies in Southeast Asia, Latin America, and Africa may suffer collateral damage if global demand and trade flows drop.

Why Markets Haven’t Crashed (Yet): Understanding Investor Psychology in the Wake of Trump’s Tariff Shocks

Despite aggressive headlines and sharp tariff announcements, financial markets have held steady—for now. But why?

🧠 Investor Sentiment: Cautious, Not Panicked

Markets have reacted with moderate declines, not full-blown sell-offs. The reason? A combination of historical context, political foresight, and behavioral finance.

1. Tariff Bluffing History: “We’ve Seen This Movie Before”

- Trump’s previous threats—like the 2018 China tariffs and the proposed Mexico border tax—often didn’t materialize or were watered down.

- Investors view his announcements as negotiation tactics, not guaranteed policy shifts.

2. Short-Term Memory & Election Cycles

- With mid-terms approaching, markets bet on political pragmatism: few believe Trump will risk a recession-level shock before a critical election cycle.

- Historical precedent shows Trump’s economic team often walks back extreme proposals under pressure.

3. Checks & Balances: Confidence in Institutional Guardrails

- Investors trust that Congress, lobbyists, and internal GOP resistance will dilute or block the harshest measures.

- Republican pushback (especially from pro-business factions) is seen as a brake on extreme trade disruption.

Long-Term Outlook: Temporary Turbulence or the Dawn of a New Economic Era?

Trump’s 2025 tariff shock may feel like déjà vu—but could this mark a deeper, structural shift in the global economy? Investors need to look beyond the headlines and assess the long-term trajectory of international trade.

📊 Are Permanent Trade Barriers Here to Stay?

- While past tariff waves have faded, political momentum now leans toward protectionism—in both U.S. parties.

- With China, tensions go far beyond economics: national security and strategic autonomy are now driving decoupling.

⟶ Analysts estimate a 60–70% chance that at least some of these trade barriers become permanent fixtures.

🏭 Reshoring & the Great Supply Chain Reset

- COVID-19 and the U.S.–China rivalry have triggered a reshoring boom, especially in tech, semiconductors, and EV batteries.

- Nations are investing in local production hubs to reduce dependence on geopolitical hotspots.

⟶ This means new winners in countries like Mexico, India, Vietnam—and logistical reconfigurations across industries.

🌍 Realignment of Global Economic Alliances

- The EU, ASEAN, and Latin American blocs may seek tighter internal trade ties to reduce exposure to U.S. volatility.

- The BRICS+ expansion could accelerate the rise of parallel trade networks, challenging Western dominance.

📈 Strategic Moves Investors Should Consider

- Diversify globally: Look beyond U.S.–China to emerging markets benefiting from the supply chain pivot.

- Bet on infrastructure & logistics: Companies enabling reshoring and regional trade will thrive.

- Monitor policy signals: Elections, treaties, and defense alignments will shape the next decade of globalization.

❓FAQ – Trump’s 2025 Tariffs: What You Need to Know

What are Trump’s new tariffs in 2025?

In early 2025, Donald Trump announced a new wave of import tariffs, including a 54% tax on Chinese goods tied to fentanyl concerns, and a 25% tariff on automotive imports from the European Union, specifically targeting German manufacturers. Some high-tech and strategic goods like pharmaceuticals, semiconductors, and rare earth minerals are temporarily excluded from these measures.

When will the new tariffs take effect?

The rollout is scheduled to begin in Q2 2025, but specific timelines vary by product and country. Key dates will depend on Congressional negotiations, legal reviews, and potential international retaliation, which makes close monitoring essential for investors and importers.

Which industries are most impacted?

The automotive sector, especially German brands, is facing higher consumer prices and pressure on U.S. sales. Technology companies dependent on Chinese manufacturing—such as Apple, Nvidia, Amazon, Google, and Meta—are vulnerable to supply chain disruption. Meanwhile, certain strategic industries benefit from temporary tariff exemptions, but that protection could be short-lived.

Could these tariffs cause a recession?

Several major financial institutions, including J.P. Morgan, forecast an increase in inflation between 1% and 1.5%, which could push the U.S. economy into recession by mid-2025. If implemented in full, the tariffs may lead to slower GDP growth, higher unemployment, and reduced consumer spending power in the short term.

Why haven’t markets crashed yet?

Despite the announcement, markets remain cautiously stable. Many investors believe that political resistance within the Republican Party, combined with Trump’s history of using tariffs as a bargaining tool, reduces the likelihood of full enforcement. Confidence in institutional checks and election-year dynamics also temper investor panic—for now.

How are global powers reacting?

The European Union is divided on its response but may eventually retaliate, especially through tighter regulations on U.S. tech firms. China is expected to counter swiftly, potentially escalating the situation into a broader trade conflict. The global trade environment is already showing signs of strain, with supply chains and multinational strategies under pressure.

Are the tariffs permanent?

While some measures appear tactical and politically driven, others—especially those concerning national security or critical industries—could become long-term fixtures in U.S. trade policy. The future will largely depend on political outcomes in Washington and the global economic climate.

What should investors do now?

Investors are advised to remain vigilant. The situation is evolving, and while some sectors may face short-term volatility, others could benefit from supply chain realignment or reshoring trends. Staying informed and responsive to both domestic policy shifts and international developments is key to navigating the months ahead.