What Happened in 2025? Trump’s “Liberation Day” and the Tariff Shockwave

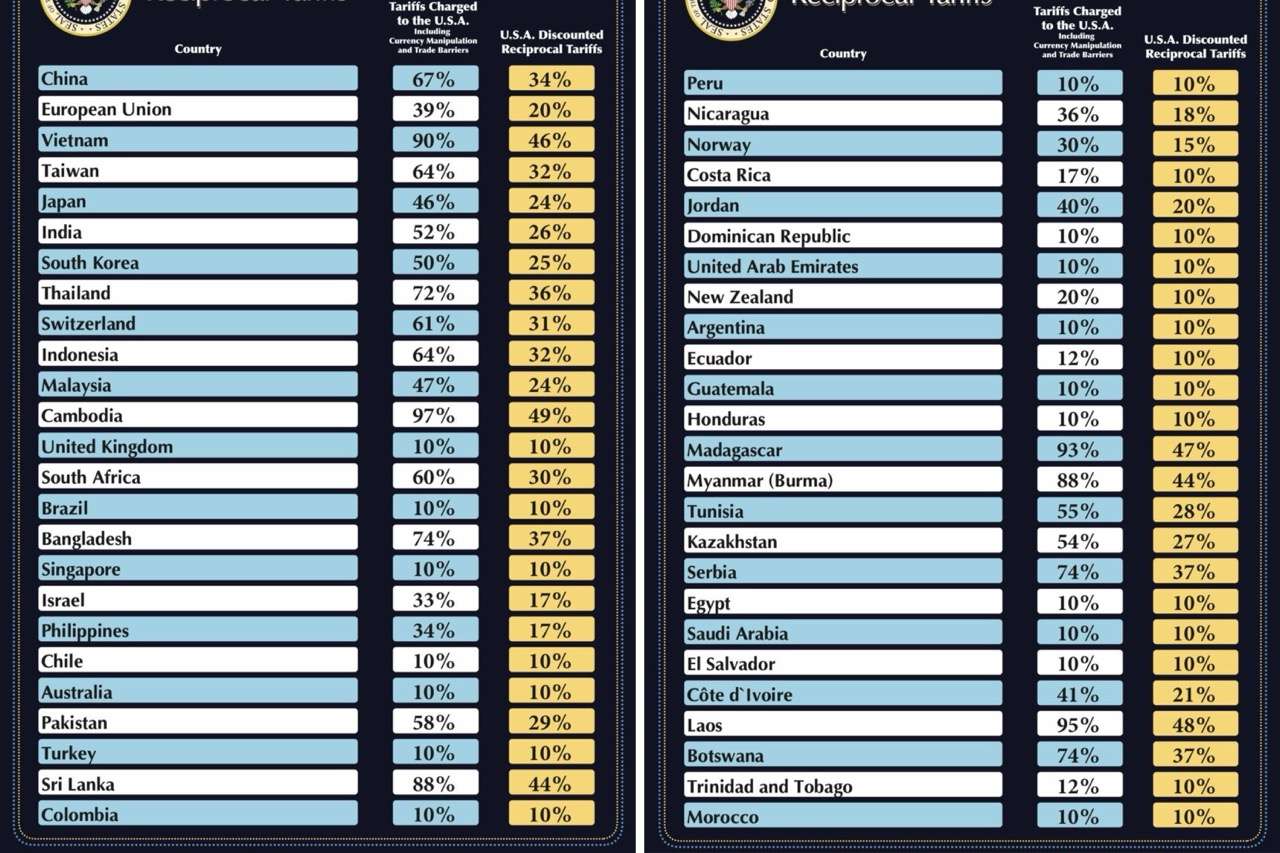

On April 2nd, 2025, former President Donald Trump made headlines with the announcement of “Liberation Day”—a bold move to reshape U.S. trade policy. The core of the announcement? A sweeping new round of tariffs aimed at protecting American industry, with China as the primary target.

Here’s what changed:

🧨 A New Tariff Era: +54% on Chinese Goods

In one stroke, the U.S. government layered a 34% “reciprocal” tariff on top of the existing 20% baseline, bringing the effective tariff on Chinese imports to 54%. That means more than half the value of many goods now goes directly to customs duties.

This affected everything from consumer electronics to industrial components, putting enormous pressure on e-commerce sellers, retailers, and manufacturers relying on Chinese supply chains.

📦 The End of the De Minimis Loophole

Until recently, importers could benefit from the “de minimis” rule, allowing small parcels under $800 to enter the U.S. duty-free. It was a lifeline for small businesses and dropshippers.

As of May 2025, that rule is gone—at least for China and Hong Kong. Now, even a $20 gadget shipped from Shenzhen is hit with 30%–50% in duties plus new flat-rate fees, making low-ticket items far less viable for direct-to-consumer models.

⚙️ A Blow to Small Importers and Industry

From Amazon sellers to parts importers and industrial buyers, the impact was immediate:

- E-commerce businesses saw profit margins evaporate overnight.

- Importers of industrial components faced sudden cost surges, threatening B2B pricing models.

- Retailers had to choose between raising prices or eating the cost.

But here’s the twist that most headlines didn’t tell you:

Despite the chaos, sourcing from China didn’t collapse.

It adapted—and smart businesses are already ahead of the curve.

Why? Because China’s supply chain dominance isn’t just about cost—it’s about capability, scale, and speed. In the sections below, we’ll show you exactly why China sourcing is still alive and well, and how companies like yours can stay competitive—even in a 54% tariff world.

So Why Is China Still Unbeatable in Global Sourcing?

Tariffs or not, one fact remains: China is still the world’s manufacturing engine. The 2025 trade tensions didn’t dismantle that—it only reminded businesses how deep their supply chains run through China.

Let’s look at what makes China irreplaceable when it comes to sourcing.

🏭 Unmatched Manufacturing Power

China isn’t just another sourcing destination. It’s the most complete industrial ecosystem on the planet.

- It has the largest manufacturing base in the world, producing more than the next nine countries combined.

- Every part of the supply chain—raw materials, components, assembly, testing, packaging, logistics—can be found within one country.

- This vertical integration isn’t accidental. It’s the result of 30+ years of focused investment, scaling, and specialization.

In plain terms? What takes three countries to do elsewhere, China does under one roof.

💡 Speed, Scale, and Innovation—At Once

In 2025, sourcing isn’t just about cost. It’s about speed to market, production flexibility, and smart innovation.

- Need a product prototype in 3 days? China can do it.

- Want 10,000 units next week and 100,000 next month? No problem.

- Chinese factories now integrate robotics, AI-driven QC, and real-time production tracking, offering a level of agility few can match.

And the best part?

You no longer have to choose between quantity and quality. With China, you get both.

🤝 Supplier Reliability That Took Decades to Build

You can find a cheaper quote elsewhere.

But can you really replace the reliability, trust, and responsiveness built over decades in China?

- Chinese suppliers understand Western buyers—from branding and packaging to compliance and timelines.

- Many offer turnkey OEM/ODM services, and they’ve worked with global brands for years.

- Communication, sampling, and problem-solving are often faster and smoother thanks to experience and scale.

📊 According to 2024 data, over 70% of Amazon sellers still rely on Chinese suppliers—despite tariffs and political pressure. That says a lot.

So yes, you can change your supplier… but can you replace a system that took 30 years to perfect?

Alternatives to China? Real Options, Real Limits

It’s true—more companies are exploring new sourcing hubs in 2025.

Vietnam, India, Mexico… they’re all on the radar. But let’s be clear:

Diversifying doesn’t mean replacing China.

And in most cases, it can’t.

Let’s break it down.

🌍 Vietnam, India, Mexico… Promising, But Still Dependent

These countries have made impressive progress. Labor costs are attractive. Governments are courting manufacturers. And the “China+1” strategy is trending.

These countries have made impressive progress. Labor costs are attractive. Governments are courting manufacturers. And the “China+1” strategy is trending.

But here’s what you need to know:

- 🏗️ Most still import raw materials and components from China. Their growth is deeply tied to China’s supply chain.

- 👷♀️ Labor force size is smaller. For context, China’s manufacturing workforce exceeds 110 million. Vietnam has around 15 million.

- 🛣️ Infrastructure and logistics remain a work in progress—slower ports, fewer suppliers, limited freight capacity.

- 📦 Product diversity is limited. Need high-precision electronics, tools, textiles and packaging in one place? Still easier in China.

💡 Reality check: If you move production to these countries, chances are, you’ll still be sourcing core components from China.

🔀 The Reality of Diversification: “China+1” Isn’t “China Replacement”

Diversification is smart. But let’s not confuse strategy with fantasy.

Most companies implementing a “China+1” approach are not leaving China.

They’re simply adding another country for risk management—while keeping their main supply lines anchored in China.

- 🚧 You might do final assembly in Vietnam, but the parts still ship from Guangdong.

- 🧩 You could move some production to Mexico, but specialty components still come from Zhejiang.

- 🧮 You’ll face higher complexity, more customs steps, and less negotiating power the further you spread your chain.

Here’s a simplified comparison:

| Criteria | China | Vietnam | India | Mexico |

|---|---|---|---|---|

| Supply Chain Depth | ✅ Full Ecosystem | ⚠️ Relies on China | ⚠️ Fragmented | ⚠️ Limited Industrial Base |

| Infrastructure | ✅ World-class | ⚠️ Developing | ⚠️ Uneven | ⚠️ Region-dependent |

| Product Diversity | ✅ All categories | ⚠️ Narrower range | ⚠️ Select sectors | ⚠️ Mostly heavy industry |

| Production Speed | ✅ Fast | ⚠️ Slower | ⚠️ Bureaucratic | ⚠️ Medium |

| Cost-to-Value Ratio | ✅ Optimized | ✅ Competitive | ⚠️ Inconsistent | ⚠️ Higher labor costs |

🎯 Smart Diversification with HAI International Holding

We’re not here to tell you China is your only option.

But we are here to help you diversify wisely—without losing the competitive edge that China offers.

- Need a hybrid model? We’ll help you split your chain between China and a second country.

- Want to compare landed costs or transit times? We run the numbers with you.

- Curious about quality, MOQs, compliance? We’ve got boots on the ground to verify everything.

How Businesses Are Navigating the Tariffs (and Winning)

A 54% tariff sounds like a dealbreaker.

But smart companies aren’t panicking—they’re adapting. And in many cases, they’re still thriving.

Here’s how businesses are keeping their China sourcing profitable in 2025.

🚚 Smarter Logistics = Better Margins

Forget the old model of cheap individual parcels.

Today’s winners are optimizing their supply chains from end to end.

- 📦 Bulk over small: Instead of shipping 500 parcels, consolidate them into one container. This reduces per-unit shipping costs and spreads the tariff impact.

- 🏢 Bonded warehouses & FTZs: By storing goods in foreign trade zones (FTZs) or bonded warehouses, you can delay or reduce import duties, repackage goods, or re-export without paying full taxes.

- 🚆 Ocean + rail hybrid routes to Europe: Need to reach the EU? Combining sea freight to Eastern Europe with rail across the continent slashes transit time and avoids congestion—and in some cases, reduces tariff exposure.

💡 Pro tip: HAI International Holding can help design and operate these mixed logistics flows—fully optimized, fully compliant.

🤝 Strategic Cost Sharing with Chinese Suppliers

Here’s something most don’t tell you:

You don’t have to absorb 100% of the tariff cost.

In 2025, many experienced Chinese factories are co-investing in solutions to protect their clients’ margins.

- 💬 Price renegotiations: It’s now common for suppliers to lower FOB prices or offer discounts to retain high-volume clients.

- 📉 Shared margin strategies: By adjusting payment terms, production methods, or packaging specs, both sides reduce overall costs.

- 🧾 Product redesign & tariff engineering: Modify components or reclassify SKUs to fall under lower tariff codes—while keeping product quality intact.

✅ With the right negotiation and guidance, tariffs become a manageable variable—not a fatal blow.

💬 With the Right Partner, China Sourcing Stays Profitable—even in a 54% Tariff World

At HAI International Holding, we don’t just move boxes.

We design supply chain strategies that protect your business—logistically, financially, and operationally.

Whether you’re shipping to the U.S., Europe, LATAM or Africa, we help you:

- Navigate tariff rules and customs complexity

- Reduce landed costs with smart routing and warehousing

- Keep your China suppliers aligned and efficient

📈 Global trade has changed. But with HAI International Holding by your side—you stay one step ahead.

[Let’s reduce your sourcing costs → Contact us now]

E-Commerce, Retail, Industry: China Still Leads

Despite tariffs, trade tensions, and all the “decoupling” talk, one truth holds firm in 2025:

From your phone case to your factory equipment—chances are, it’s still Made in China.

Let’s look at why businesses in e-commerce, retail, and heavy industry continue to rely on China as their main sourcing hub.

🛒 Dropshippers and Amazon Sellers: Still Powered by China

For e-commerce sellers, China is more than a supplier—it’s the backbone of their entire model.

Even with the end of the de minimis exemption, smart sellers have adapted:

- 📦 Bulk importing instead of per-order shipping

Sellers now consolidate orders into pallets or containers, import them to local warehouses, and fulfill domestically. - 🏠 Use of 3PL and FBA (Fulfilled by Amazon) centers

Many use Amazon warehouses or local fulfillment providers to reduce delivery times and regain margin.

At the same time, Chinese suppliers are doing their part:

- 📉 Offering flexible MOQs and pricing adjustments

- 🔧 Customizing packaging and labels for local compliance

- 🚚 Supporting hybrid fulfillment models (e.g. shipping bulk to hub + dropshipping backup)

📊 Fun fact: In 2024, over 70% of Amazon sellers still relied on Chinese-made products. That number remains strong in 2025, even after tariffs.

Why? Because no other country offers the same product variety, pricing, and adaptability.

🏭 Industrial Buyers: No Alternative for Scale and Sophistication

From automotive to aerospace, global manufacturers continue to source core components and machinery from China.

- ⚙️ Precision tools, electronics, semiconductors, motors—China dominates global output in nearly every major industrial category.

- 🔌 Integrated supply chains mean faster delivery, lower defect rates, and full compliance with international standards.

- 🧰 Turnkey production solutions: Chinese manufacturers don’t just make parts—they co-design, assemble, and even test products for export.

🔍 Why not just switch to another country?

Because no other market today has the scale, talent pool, and infrastructure to replicate China’s manufacturing ecosystem.

Even companies that relocate final assembly to Mexico, Vietnam, or Eastern Europe often still depend on China for key inputs—motors, PCB boards, molds, lithium batteries, etc.

✅ China = The Core. Still.

Whether you’re selling smartphone accessories on Shopify or building a robotics platform for industrial automation, your supply chain probably starts in China.

And with the right logistics partner, that supply chain remains:

- 💸 Cost-effective

- ⏱ Fast

- 📦 Reliable

- 🔒 Protected against geopolitical shocks

HAI International Holding: Your Ally in the New Era of Sourcing from China

Tariffs may have changed the rules.

But with the right partner, you’re not just surviving—you’re thriving.

At HAI International Holding, we don’t just move your goods.

We build sourcing strategies that protect your margins, simplify your logistics, and keep your business growing—even in a 54% tariff world.

🤝 Why Work With HAI International Holding in 2025?

🛠️ Tailored Sourcing & Shipping Solutions

No two businesses are alike. Whether you’re an Amazon seller, industrial buyer, or multinational brand, we craft custom strategies that fit your volume, speed, and budget goals.

💼 Supplier Negotiation & Factory Inspections

We’re not just a logistics provider—we’re on the ground in China.

Our local teams help you find the right suppliers, negotiate better terms, and inspect production lines before anything ships.

⚖️ Tariff Navigation & Legal Compliance

Stuck on HTS codes? Confused by bonded zones or de minimis rules?

We help you optimize your shipping routes, leverage Free Trade Zones, and even explore tariff engineering strategies—all 100% compliant.

🌐 Local Presence in Every Major Port City

From Guangzhou, Shenzhen, Ningbo, to Yiwu and Shanghai, we’ve got boots on the ground where it matters.

Your freight stays visible, secure, and on time.

Ready to Keep Winning with China Sourcing in 2025?

The rules have changed—but the opportunities are still massive.

If you know how to adapt, sourcing from China remains one of the smartest moves you can make.

At HAI International Holding, we help businesses like yours stay ahead of the curve—with flexible strategies, efficient logistics, and boots-on-the-ground expertise across China.

Whether you’re scaling an e-commerce brand, optimizing your industrial supply chain, or looking to diversify without losing performance—we’re here to help you win.

✅ Let’s Take the Next Step, Together

🌏 China isn’t dead—it’s evolving. And with the right partner, you evolve with it.

Let’s unlock your next stage of growth with confidence.

FAQ – Sourcing from China After Trump’s 2025 Tariffs

Is sourcing from China still profitable in 2025?

Yes, sourcing from China is still profitable—even with higher tariffs. While costs have increased, most importers adapt by consolidating shipments, negotiating better terms with suppliers, or using strategies like bonded warehousing and tariff engineering. Chinese manufacturers remain highly competitive on pricing, speed, and production quality, which means many products are still cheaper to produce in China than elsewhere, even after duties.

What kinds of products are most affected by the new tariffs?

Consumer electronics, batteries, and certain machinery categories have seen the highest additional tariff rates—sometimes exceeding 50%. That said, the impact varies by product type and HS code. Many items still qualify for lower rates depending on how they're classified or whether they’re modified before import. That’s why having the right customs strategy is now more important than ever.

Can I still dropship from China to the U.S.?

Dropshipping from China to the U.S. is still possible, but it has become less profitable due to the elimination of the de minimis rule for Chinese parcels. Most successful sellers now import in bulk to a U.S.-based warehouse, then fulfill orders domestically. This adds a layer of logistics complexity, but it allows you to maintain speed and reduce per-unit shipping costs while staying compliant.

What’s the best way to reduce my import costs from China now?

The most effective approach is to rethink your entire supply chain. Instead of shipping individually packaged items, consolidate your orders and use tools like foreign trade zones or bonded warehouses. Reworking product specifications to fit into a lower tariff category (a method known as tariff engineering) is also a smart tactic. Working with a partner like HAI International Holding helps you identify the right mix of tactics based on your business model.

Are there better alternatives to China for sourcing in 2025?

There are complementary alternatives, but not outright replacements. Vietnam, India, and Mexico are growing, but they often rely on China for raw materials or components. Their infrastructure and supplier diversity remain limited in comparison. Many companies use a “China+1” strategy, where they diversify final assembly or some production to other countries, but still depend on China for key parts and scale.

How can HAI International Holding help me adapt to these changes?

HAI International Holding offers end-to-end support for businesses navigating the post-tariff landscape. We help you plan smarter sourcing strategies, optimize your freight routes, consolidate shipments, use bonded zones, and work directly with trusted Chinese factories. Our presence on the ground across major ports and industrial zones gives you visibility, leverage, and peace of mind. In short, we help you protect your margins without losing the benefits of sourcing from China.