Thinking of importing from China? Whether you’re launching a private label brand or scaling your e-commerce store, customs fees can make or break your profit margins. Yet, many importers—especially first-timers—underestimate this hidden cost. That’s a mistake you can’t afford.

In this ultimate guide, we’ll break down exactly how customs duties are calculated, how you can legally reduce them, and what you need to know in 2024 to stay compliant and competitive. From HS codes to Incoterms, we’re demystifying the fine print so you can ship smarter, not harder.

1.1 Why Customs Fees Are a Critical Part of Your Import Cost

When importing from China, product price is only half the equation. The real cost lands when your goods hit the border—and customs duties kick in. Whether you’re shipping to the EU, the US, Canada, or the UK, customs fees can add 5–40% to your landed cost if you’re not careful.

Fail to account for them upfront, and you risk:

- Destroying your profit margin,

- Getting stuck with surprise charges at customs,

- Facing delays or even seized goods.

By understanding and budgeting for import taxes and duties from the start, you gain full control of your landed costs and pricing strategy.

1.2 Key Terms You Must Know Before Importing from China

Here’s a quick primer on the jargon every importer needs to master:

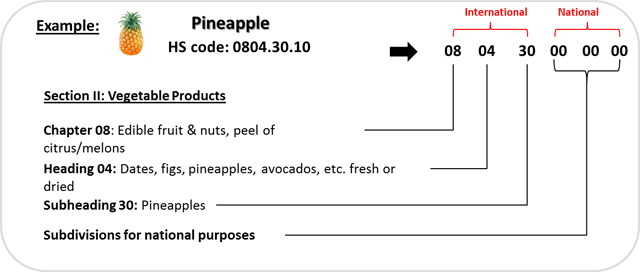

- HS Code (Harmonized System): A standardized 6–10 digit code used to classify products worldwide. Determines your duty rate.

- CIF (Cost, Insurance, Freight): A valuation method where duties are based on product cost plus shipping and insurance. Common in the EU.

- FOB (Free on Board): An Incoterm where you only pay for the product cost up to the port of departure—often better for controlling customs values.

- Incoterms: International rules that define who pays what in the shipping process. Your choice (e.g. FOB vs CIF) directly affects how customs fees are calculated.

- De Minimis Threshold: The value under which goods can enter a country without paying duties or taxes. Varies by country (e.g. $800 in the US, €150 in the EU).

- IOSS (Import One-Stop Shop): A simplified EU VAT system for low-value imports (≤€150) aimed at e-commerce sellers.

By getting familiar with these terms now, you’ll avoid costly mistakes later. Let’s dive deeper into how to calculate your customs fees like a pro.

Classify and Value Your Goods

Before you can calculate customs fees, you need to speak the same language as customs authorities. That starts with correctly classifying your product and assigning it an official customs value. Get this wrong, and you risk overpaying—or worse, triggering audits or delays. Let’s walk through the first critical step to mastering customs duty calculation.

3.1 Find Your HS Code (TARIC for the EU, HTSUS for the U.S.)

Every product shipped internationally must be classified using the Harmonized System (HS Code)—a 6- to 10-digit number that determines the applicable duty rate, taxes, and even potential restrictions.

- For EU imports: Use the TARIC database from the EU Taxation and Customs Union.

- For U.S. imports: Use the HTSUS database provided by U.S. Customs and Border Protection (CBP).

🔍 Pro Tip: Even a one-digit error in your HS code can mean the difference between 0% duty… and 12%. Double-check your code with your supplier or freight forwarder.

3.2 Determine the Customs Value: CIF vs FOB

The customs value is the amount on which your import duties and taxes are calculated. It depends on whether you’re using FOB or CIF pricing:

- FOB (Free on Board): Includes only the cost of the product + local Chinese charges (inland transport, export clearance). Ideal if you want to minimize your taxable base.

- CIF (Cost, Insurance, Freight): Includes the FOB value plus international shipping and insurance. This results in a higher customs value—and therefore, more duties and VAT.

📦 Most customs authorities—especially in the EU—prefer CIF as the basis for duty calculation. But if you’re negotiating with your supplier, FOB is often your best bet for controlling costs.

3.3 How Incoterms Impact Your Taxable Base

Incoterms (International Commercial Terms) define who pays for what in the shipping process—and directly influence your customs fees.

Here’s why it matters:

- If you choose FOB, your taxable base excludes freight and insurance, reducing import costs.

- If you choose CIF, you pay duties on the full shipment value, including shipping and insurance—even if you didn’t arrange it.

- DDP (Delivered Duty Paid)? You’re handing over control to the supplier—and often paying inflated fees without knowing the breakdown.

🚀 Smart importers always negotiate Incoterms. FOB offers more transparency, better cost control, and fewer surprises at customs.

Calculate Duties and Taxes – The Universal Method

Now that your product is classified and valued correctly, it’s time to tackle the big question: how much will you actually pay at customs?

Whether you’re importing into the EU, U.S., Canada, UK, or Australia, the formula for customs duty and tax calculation is surprisingly consistent worldwide. Let’s break it down.

4.1 The Universal Formula for Calculating Customs Costs

Here’s the industry-standard formula used by customs brokers and freight forwarders around the world:

Here’s the industry-standard formula used by customs brokers and freight forwarders around the world:

➤ Customs Duty = Duty Rate × Customs Value (FOB or CIF)

➤ Import Tax (e.g., VAT, GST) = Tax Rate × (Customs Value + Duty + Domestic Charges)

Example (EU, CIF Basis):

Let’s say you’re importing goods from China worth €10,000 CIF.

- Customs Duty Rate = 5%

- VAT Rate (France) = 20%

1. Duty = €10,000 × 5% = €500

2. VAT = 20% × (€10,000 + €500) = €2,100

✅ Total Import Cost = €2,600

💡 Note: In many countries, local delivery charges (from port to warehouse) are included in the VAT base. Always check your local rules.

4.2 Use Tools to Simplify the Math

If you’re not a fan of spreadsheets, good news—there are free calculators that do the work for you.

🔧 Top Tools to Estimate Your Import Costs:

- DHL & FedEx Duty Estimators – Useful if you’re shipping via express couriers.

- National Customs Portals – Many countries (like France’s douane.gouv.fr) offer calculators or simulation tools.

💬 Pro Tip: Always double-check with your customs broker or freight forwarder, especially if you’re shipping high-value or regulated goods. They can ensure you’re compliant and not overpaying.

Customs Fees by Region – What You Really Pay, Country by Country

Customs fees aren’t one-size-fits-all. Each country has its own set of rules, thresholds, and taxes that can dramatically change your bottom line. If you’re shipping from China, here’s exactly what to expect in your key markets.

5.1 European Union (EU)

Duties: The EU calculates customs duties using the TARIC system, based on HS codes. Most consumer goods fall between 0% and 17%, though some exceptions (e.g., shoes, textiles, electronics) apply.

➡️ Check your exact rate here: TARIC Database

VAT: Each country applies its national VAT rate—20% in France, 19% in Germany, 21% in Spain.

🔻 Since July 1, 2021, the €22 VAT exemption was abolished—all goods, regardless of value, are now subject to VAT.

IOSS & ViDA: The Import One-Stop Shop (IOSS) simplifies VAT collection for low-value goods (≤€150). But by 2028, the EU’s ViDA reform plans to abolish the €150 de minimis threshold entirely.

➡️ Get ready to pay full VAT on everything.

🇫🇷 Example – Shipping to France

- Product CIF value: €1,000

- Duty rate: 4% → €40

- VAT base = €1,040 → VAT (20%) = €208

✅ Total import cost: €1,248

5.2 United States

De Minimis Rule: Thanks to Section 321, U.S. importers enjoy one of the world’s highest tax-free thresholds:

📦 $800 USD per shipment, per day is duty-free—perfect for e-commerce.

2025 Reforms Incoming:

- Tariff 301 Products (mainly from China) may soon be excluded from de minimis.

- In May 2025, a Trump-era executive order began phasing out the $800 exemption specifically for Chinese goods.

- A Biden administration proposal may reinforce this in 2025–2026.

📉 If you rely on volume dropshipping from China—this could hit hard.

5.3 United Kingdom

Post-Brexit Customs: The UK set its own threshold:

- £135 GBP: Above this, customs duties apply.

- Below it? VAT still applies, and sellers must collect it at the point of sale.

📢 Under review: Chancellor Rachel Reeves is reportedly exploring changes to close loopholes used by ultra-low-cost platforms like Shein and Temu.

Stay tuned for updates in the next budget cycle.

5.4 Canada

Canada has one of the world’s most complex de minimis structures:

| Shipment Type | Duty-Free Threshold | Tax-Free Threshold |

|---|---|---|

| Postal (from China) | 20 CAD | 20 CAD |

| Courier (from US/Mexico) | 40 CAD | 150 CAD |

| Courier (from China/Other) | 20 CAD | 20 CAD |

💡 Key point: Duties kick in at 20 or 40 CAD, depending on the origin and method of shipping. Taxes apply above the threshold unless using a trade partner courier under special programs like CLVS (Courier Low Value Shipment).

5.5 Other Markets (Quick Comparison)

| Country | Duty-Free Threshold | Taxation Rules |

|---|---|---|

| Australia | AUD 0 | 10% GST on all imports |

| Switzerland | CHF 5 (duty), CHF 60 (VAT) | Based on weight/value per product type |

| New Zealand | NZD 1,000 | GST + customs duties after that |

📦 Bottom Line: Knowing your destination country’s thresholds and tax policies isn’t optional—it’s essential. From CIF vs. FOB valuation to IOSS and Section 321, small choices can lead to big savings—or major costs.

Hidden Fees & Pitfalls That Can Crush Your Margins

You’ve found a great supplier. You’ve calculated your customs duties. You’ve even accounted for VAT. But you’re still getting slammed with unexpected costs?

Welcome to the world of special tariffs, environmental taxes, and fine-print brokerage fees. These hidden costs often go unnoticed—until they eat into your profits.

Here’s what you must watch out for when importing from China:

6.1 Anti-Dumping Duties: The Silent Profit Killer

You may have cleared standard customs duty… but still face extra charges under anti-dumping regulations.

The EU, U.S., and other countries impose anti-dumping duties (ADDs) to protect local industries when imports are sold “below fair market value.”

📌 Common Chinese goods hit with ADDs:

- Electric bikes (EU duty up to 62%)

- Bicycle parts

- Solar panels

- Steel and aluminum products

🔍 Check before you import: Always verify on EUR-Lex or consult a customs expert.

💸 These duties are stacked on top of regular import duties—and often catch sellers off guard.

6.2 Green Taxes & Excise Duties: The Hidden Environmental Surcharges

Some products come with environmental or excise taxes, often applied during customs clearance:

- Batteries (lithium-ion, lead-acid): subject to eco-contributions in the EU.

- Alcohol & Tobacco: face excise duties based on volume and alcohol percentage.

- Electronics & Packaging: many European countries require EPR compliance (Extended Producer Responsibility)—a fee to cover recycling obligations.

🌱 Sustainable product categories often carry a cost. These aren’t always visible on your invoice—but they’re real at the border.

6.3 Broker Fees & DDP Traps: When “All-Inclusive” Isn’t

You might be tempted by a Chinese supplier offering DDP (Delivered Duty Paid) shipping—“No customs hassle, we handle everything.” Sounds great, right?

⚠️ Here’s the problem:

- These suppliers often inflate fees, using undisclosed third-party brokers.

- You lose visibility on what’s being paid (and whether it’s compliant).

- Customs can still hold or reject shipments if documentation is lacking.

🔎 Better Option: Choose FOB terms and work with a trusted freight forwarder or customs broker. You’ll maintain control—and get full cost transparency.

💼 Bottom Line:

Ignoring these hidden charges can blow up your logistics budget. But with the right prep—checking anti-dumping lists, understanding excise risks, and avoiding DDP traps—you stay ahead of the curve and protect your margins.

Exemptions & Smart Cost-Saving Strategies

Here’s the truth: you don’t always have to pay full customs fees.

Savvy importers know the right programs, legal exemptions, and shipping terms to slash duties and taxes—without cutting corners. In this section, we’ll show you how to take advantage of customs-friendly programs that let you keep more money in your pocket.

7.1 Duty Drawbacks & Inward Processing: Get Money Back (Legally)

Duty drawback programs allow you to reclaim customs duties on imported goods that are:

- Re-exported without being sold,

- Used in manufacturing for export,

- Or returned to the supplier.

🔄 Inward Processing Relief (IPR) in the EU and similar schemes worldwide let you import raw materials duty-free, provided you export the final product later.

💰 If you’re part of a global supply chain—these programs are gold. Talk to your customs broker about how to apply and stay compliant.

7.2 Low-Value Programs: IOSS, Section 321 Type 86, and CLVS (Canada)

If you’re shipping small parcels from China, especially for e-commerce, here’s how to legally avoid paying full customs charges:

- 🇪🇺 IOSS (Import One-Stop Shop):

For goods ≤ €150, sellers can collect VAT at checkout, then skip the customs hassle in the EU.

🔒 Requires registration—perfect for platforms like Shopify, Amazon, or independent sellers. - 🇺🇸 Section 321 (Type 86 Entry):

U.S. importers can clear shipments under $800 duty-free using a Type 86 entry.

It’s fast, paperless, and ideal for daily small-package volumes.

⚠️ But goods subject to tariffs (e.g., Chinese items hit by Section 301) may be excluded. - 🇨🇦 CLVS Program (Courier Low Value Shipment):

Streamlines customs clearance for courier shipments up to CAD 3,300.

Tax and duty thresholds vary (20–150 CAD), but customs is much faster under CLVS.

📦 Low-value = low friction—if you’re doing D2C or dropshipping, these programs are essential to scale cost-effectively.

7.3 Negotiate Your Incoterms: Why FOB is Still King

One of the simplest—and most overlooked—ways to cut customs fees?

Negotiate the right Incoterm with your Chinese supplier.

- FOB (Free On Board) means:

- You pay only for the product and inland delivery to the port.

- You choose your own freight forwarder.

- You keep control of the invoice value—and your customs valuation base.

By contrast, CIF (Cost, Insurance, Freight) includes shipping and insurance in the customs value—raising your duty and VAT bill.

🧠 Smart move: Always ask for quotes in FOB terms and work with a reliable shipping partner to manage the rest. It’s how pros keep their costs predictable.

🧾 Bottom Line: There’s more than one way to lower your customs bill—and none involve breaking the rules. Whether it’s claiming refunds, using small-parcel programs, or choosing smarter Incoterms, the secret is to know the tools and use them to your advantage.

The Step-by-Step Customs Clearance Process

You’ve sourced your product, arranged the shipping, and calculated your duties—now what?

It’s time to clear your goods through customs and get them delivered. But don’t worry: this process doesn’t have to be a mystery. Here’s exactly how it works, step-by-step, no matter where you’re shipping to.

Knowing the flow means no delays, no unexpected fees, and no unhappy customers.

🧾 Step 1: Pre-Alert & Shipping Documents

Before your cargo arrives, your freight forwarder or courier submits a pre-alert to the destination’s customs office.

This includes:

- Bill of Lading (B/L) or Air Waybill (AWB)

- Commercial Invoice (must reflect correct HS code, value, Incoterms)

- Packing List

- Any relevant certificates or licenses (CE, FDA, MSDS, etc.)

⏱️ Tip: Pre-alerts speed up clearance—customs can start reviewing documents before your goods arrive.

🛃 Step 2: Customs Declaration

Your goods now enter official customs territory. Here’s what happens:

- Your broker or courier files a declaration (electronically in most countries)

- This includes the customs value, HS code, origin, and shipment details

- Customs systems assign a risk score → this determines whether your goods go through:

- Green channel (automatic release)

- Yellow channel (document check)

- Red channel (physical inspection)

🇪🇺 EU shipments under €150? → Filed via H7 declaration or through IOSS.

🇺🇸 U.S. shipments under $800? → Use Section 321 Type 86 Entry.

💳 Step 3: Duties, Taxes & Fees Payment

Once cleared, customs generates an invoice for:

- Customs Duties

- Import VAT / GST / Sales Tax

- Any special fees (e.g., anti-dumping, eco taxes)

These must be paid before goods are released.

If you’re using a courier (like DHL, UPS), they often pre-pay and charge you afterward.

🧾 Pro Tip: Always confirm who pays the fees—you or your supplier—especially if shipping under DDP terms.

🧪 Step 4: Inspection (if flagged)

If customs selects your shipment for inspection:

- Goods may be opened, X-rayed, or sampled

- Any discrepancy in documents can cause fines or delays

📦 Common triggers: undervaluation, high-risk product categories (toys, electronics, medical items), incomplete paperwork.

🚚 Step 5: Release & Final Delivery

Once everything checks out and payment is confirmed:

- Goods are released from customs custody

- Your forwarder or courier handles last-mile delivery to your warehouse, 3PL, or customer

🔐 In the EU, customs clearance = free circulation—your goods can be resold across member states with no extra duties.

✅ Summary Checklist: What You Need Ready

- ✔️ Commercial Invoice with correct HS code

- ✔️ Packing List

- ✔️ Incoterm clearly defined (FOB recommended)

- ✔️ Broker or courier assigned

- ✔️ Any required licenses or certificates

- ✔️ Payment method for duties & taxes set up

📦 Bottom Line: Customs clearance doesn’t need to be scary—if you follow the right process.

With accurate documentation, smart Incoterms, and a reliable broker, your goods will clear faster, smoother, and without drama.

Pre-Shipment Checklist – 10 Things to Confirm Before You Ship from China

One small mistake before shipping can cost you thousands.

One small mistake before shipping can cost you thousands.

Whether you’re importing by sea, air, or express, use this quick 10-point checklist to avoid customs headaches, delays, and hidden charges. Tick these off before your goods leave China.

✅ 1. Correct HS Code Confirmed

Double-check the Harmonized System (HS) code with your freight forwarder or broker. It determines your duty rate, required documents, and even whether your shipment needs extra certificates.

✅ 2. Product Value Clearly Stated (FOB/CIF)

Make sure your commercial invoice reflects the agreed valuation:

- FOB if you want to minimize duties

- CIF if shipping includes freight + insurance

Misreporting can lead to fines or delays.

✅ 3. Incoterm Negotiated & Applied

Your Incoterm defines responsibility and cost split.

📦 FOB is best for cost control and customs transparency.

🚫 Avoid vague terms like “DDP” unless you trust the supplier’s broker.

✅ 4. All Documents Ready

Check your export documentation includes:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificates (CE, FDA, MSDS, etc. if required)

✅ 5. Check for Restricted or Controlled Goods

Are you shipping electronics, batteries, toys, or medical devices?

These may require special licenses, labelling, or declarations.

✅ 6. Customs Broker or Freight Forwarder Assigned

Don’t wait until the goods arrive.

Ensure a licensed customs broker or shipping partner is ready to handle clearance in the destination country.

✅ 7. Duties & Taxes Budgeted

Use a calculator (like Easyship or FedEx) to estimate total import costs, including:

- Customs Duty

- VAT/GST/Sales Tax

- Broker fees, anti-dumping duties, etc.

✅ 8. Insurance Coverage in Place

Protect your shipment against loss, theft, or damage—especially for sea freight.

📌 Cargo insurance is often excluded unless you request it.

✅ 9. Packaging Meets Destination Requirements

Use compliant packaging (e.g., ISPM 15 for pallets in EU/US), and ensure labels include:

- Country of origin

- HS code (optional but helpful)

- Safety info if applicable

✅ 10. Clear Communication with Supplier

Align with your Chinese supplier on:

- Ready date

- Final unit count & specs

- Loading photos if needed

- Pickup time & contact for your forwarder

🎯 Final Word:

If you ship without this checklist, you’re flying blind. But if you follow these 10 steps, you’re well ahead of 90% of new importers—and your cargo will flow across borders faster, cleaner, and cheaper.

Conclusion: Stay Ahead of Customs Regulations—Before They Change Again

Global trade is changing—fast.

What’s allowed today might be restricted tomorrow. VAT thresholds, de minimis limits, and customs duties are constantly being updated across the EU, US, UK, Canada, and beyond.

🧭 The only way to stay profitable as an importer?

Anticipate changes before they impact your margins.

Here’s what smart importers do:

- They track customs news and trade policy updates.

- They work with proactive freight forwarders who flag risks early.

- And they build buffers into their pricing to protect against sudden cost hikes.

Whether you’re launching your first product or scaling a 7-figure e-commerce brand, knowing how to calculate, reduce, and strategically plan for customs fees is your edge in 2024—and beyond.

🔐 Importing from China is no longer just about cheap prices. It’s about control, compliance, and long-term profit.

Use this guide as your blueprint—and you’ll never be caught off guard at the border again.

📌 Frequently Asked Questions (FAQ)

How are customs duties calculated when importing from China?

Customs duties are calculated by multiplying the duty rate by the customs value of the goods. This value is based on either the FOB (Free On Board) or CIF (Cost, Insurance, and Freight) price, depending on your shipping terms. Once duties are added, VAT or GST is then applied to the total amount, including shipping and customs fees.

What is the de minimis threshold in my country?

In the United States, the de minimis threshold is $800 under Section 321. In the European Union, customs duties are waived for shipments under €150, but VAT applies to all imports regardless of value. The United Kingdom sets its threshold at £135, while Canada applies different thresholds depending on the shipping method, starting at 20 CAD. In Australia, there is no duty-free threshold and a 10% GST applies to all imported goods.

What is the best Incoterm for importing from China?

FOB (Free On Board) is generally the best choice for importers because it gives you control over your logistics and keeps your customs valuation lower. CIF includes freight and insurance in the value, which increases the amount you'll pay in duties and taxes. With FOB, you decide your shipping route and manage costs more transparently.

What documents are required for customs clearance?

You will need a commercial invoice, a packing list, and a bill of lading or air waybill. It's also essential to include the correct HS code and, if applicable, any compliance certificates such as CE, MSDS, or FDA. Your customs broker or freight forwarder will usually handle the submission and ensure the documents meet regulatory standards.

How do I find the right HS code for my product?

You can find your HS code using the official TARIC database for the EU or the HTSUS platform in the U.S. Customs classification is based on the nature, material, and use of the product. It’s important to be precise, as errors can lead to overpaying duties or delays at customs. A trusted supplier or freight forwarder can help confirm your classification.

What are anti-dumping duties and how do they affect me?

Anti-dumping duties are extra tariffs imposed when a product is deemed to be imported at unfairly low prices that harm domestic industries. These duties are common for goods like electric bikes, solar panels, and certain steel or aluminum products from China. They apply on top of regular customs duties and can significantly increase your landed costs.

Can I reduce or recover customs fees?

Yes, several legal mechanisms allow you to reduce or even reclaim customs duties. If your goods are re-exported or used in the manufacturing of products destined for export, you may be eligible for duty drawback or inward processing programs. Small parcels may also benefit from simplified clearance programs like IOSS in the EU or Section 321 Type 86 in the U.S. Choosing the right Incoterm, such as FOB, can also lower your customs valuation and related fees.

How can I stay updated on customs rule changes?

You can follow official government sources like the EU Taxation and Customs Union portal or the U.S. CBP website. Freight forwarders and customs brokers often send newsletters or offer alerts on major policy updates. Staying informed is essential as customs thresholds, tax regulations, and tariffs evolve rapidly, especially in high-volume trade corridors like China to the West.